Income Limits For Roth Ira Contributions 2025 Over 50 - Qualified roth ira distributions are not subject to income tax or capital gains tax. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Qualified roth ira distributions are not subject to income tax or capital gains tax.

IRA Contribution Limits in 2025 & 2023 Contributions & Age Limits, In 2025, you can only invest $7,000 in a roth ira, or $8,000 if you're age 50 or older. Those are the caps even.

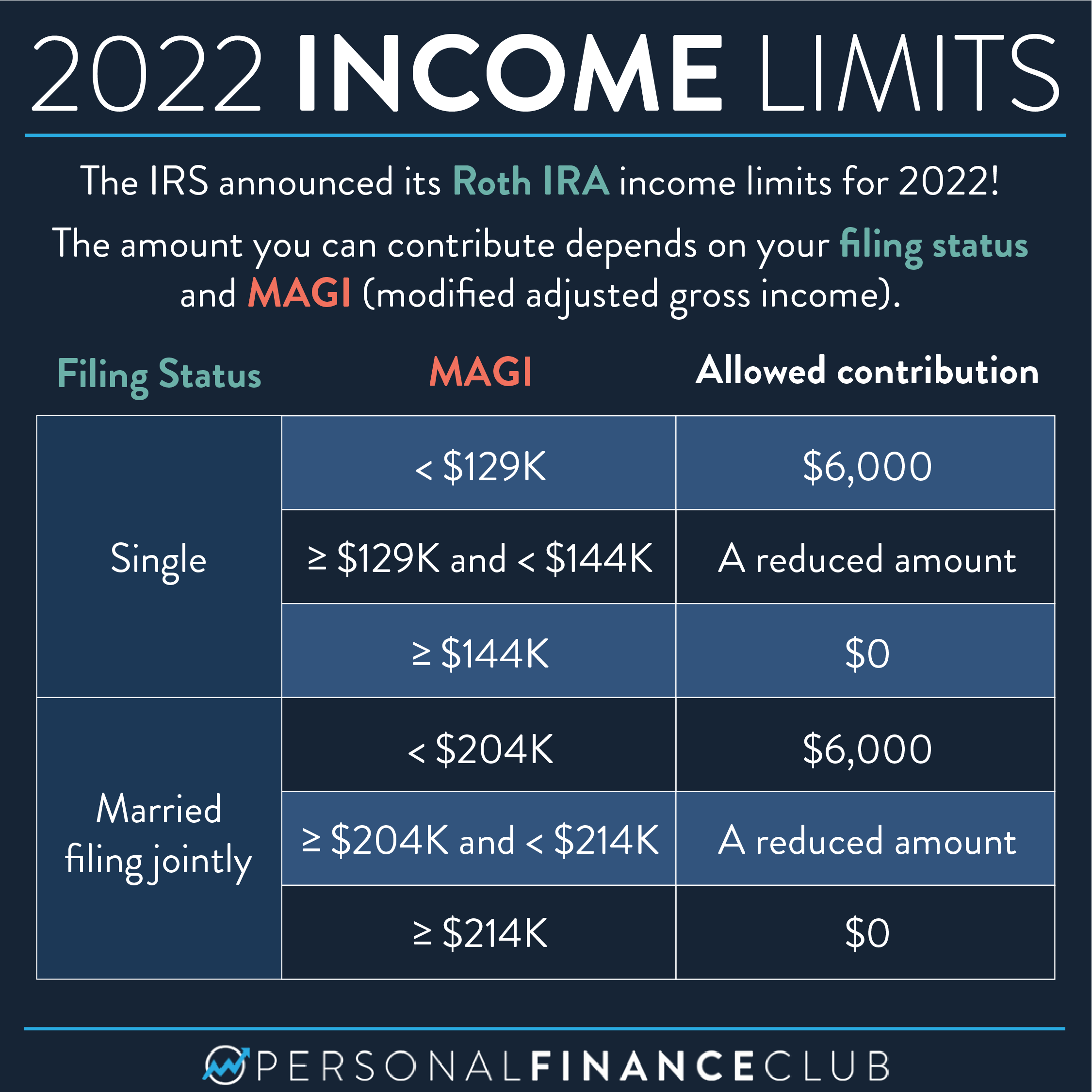

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Roth ira contributions for 2023 can be made up to the tax deadline.

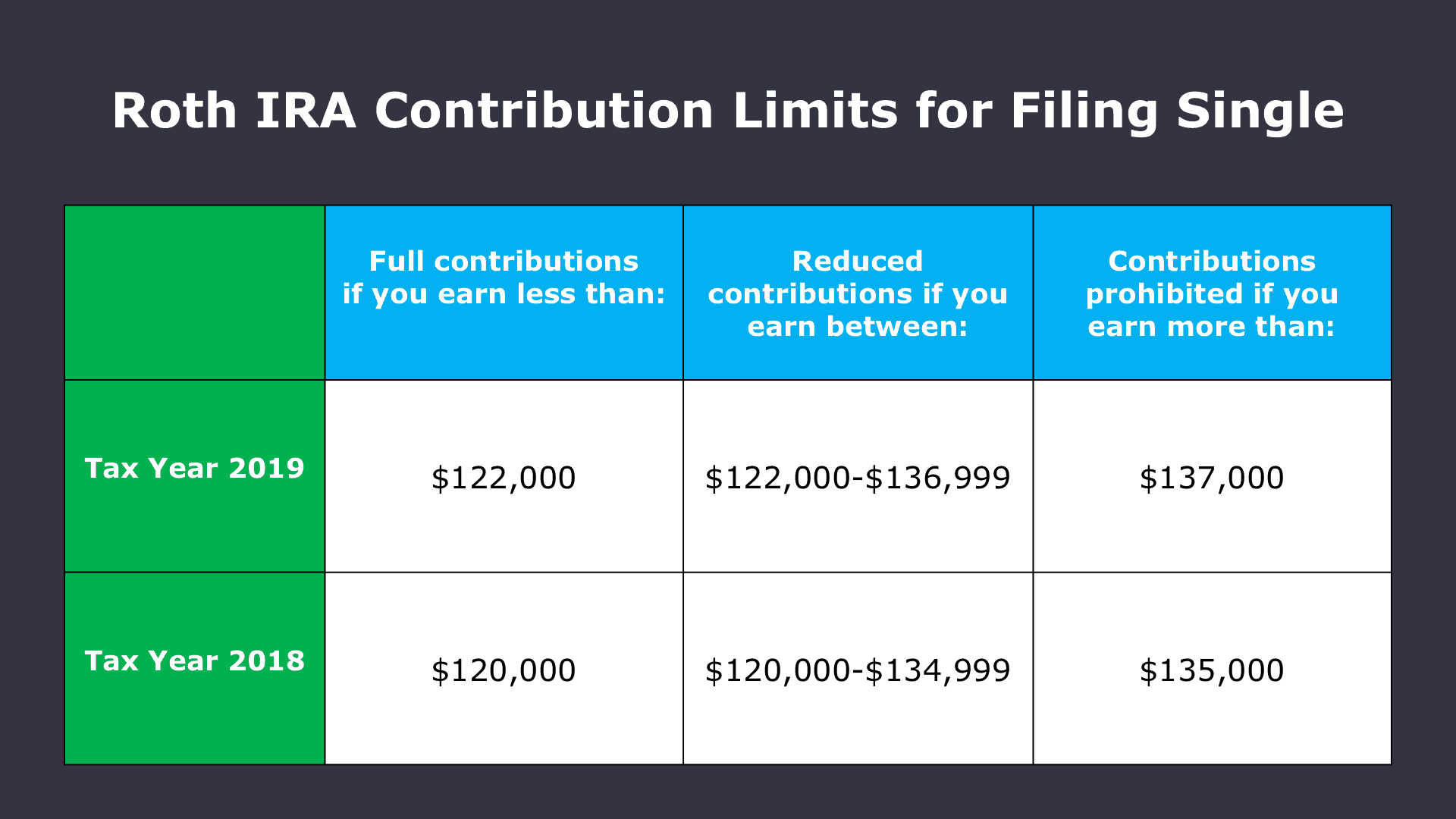

Historical Roth IRA Contribution Limits 1998 2025 Ira contribution, Now, after secure act 2.0, contributions would look like this: 2025 roth ira contribution limits.

Roth IRA Rules What You Need to Know in 2025 Roth ira rules, Roth, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. $8,000 in individual contributions if you’re 50 or older.

Investing in a roth ira means your money grows free from the irs’s grasp, ensuring.

Roth 401k Annual Limit 2025 Etty Geraldine, In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira. Roth ira contributions for 2023 can be made up to the tax deadline.

Income Limits For Roth Ira Contributions 2025 Over 50. In 2025, you can only invest $7,000 in a roth ira, or $8,000 if you're age 50 or older. Whether you can contribute the full amount to a roth ira depends on your.

Roth ira contributions for 2023 can be made up to the tax deadline.

IRS Unveils Increased 2025 IRA Contribution Limits, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older. Qualified roth ira distributions are not subject to income tax or capital gains tax.

Ihda Limits 2025 Maura Sherrie, How much you can contribute is limited by your income level,. Whether you can contribute the full amount to a roth ira depends on your.

The IRS announced its Roth IRA limits for 2025 Personal, You can contribute up to 100% of your child's earned income to the roth ira, with a maximum limit of $7,000 for 2025. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

Now, after secure act 2.0, contributions would look like this: If you qualify, you can contribute up to $7,000 if you are under 50.